Los Angeles is home to some of the most competitive and fast-moving industries in the world—entertainment, tech, fashion, real estate, and beyond. While the opportunities are vast, the financial challenges are equally complex. Businesses in L.A. face a unique mix of California’s strict tax codes, city-specific regulations, and the constant pressure of operating in a high-cost, high-speed market.

Outsourced accounting services offer a powerful solution. Instead of treating accounting as a back-office task, Los Angeles businesses that outsource gain a strategic partner who understands the city’s financial landscape. Outsourced professionals not only ensure compliance but also uncover inefficiencies, improve cash flow management, and provide insights that help companies scale confidently. For growing companies, especially those seeking affordable outsourced accounting services for small firms, this approach delivers both financial precision and strategic growth support.

The true benefit goes beyond accurate bookkeeping. For businesses in Los Angeles, outsourced accounting delivers financial intelligence tailored to the demands of one of the world’s most competitive markets. By leveraging expert support, business owners can redirect their time toward growth, innovation, and serving clients—while knowing their finances are managed with precision.

Top Takeaways

- Saves time and reduces stress.

- Ensures compliance with California tax rules.

- Provides clarity to uncover hidden costs.

- Offers scalable expertise without full-time costs.

Gives L.A. businesses a competitive edge.

Why Outsourced Accounting Matters for L.A. Businesses

Los Angeles businesses operate in a unique environment where creativity and innovation thrive—but so do financial complexities. From navigating California’s strict tax regulations to managing payroll in industries with high turnover, business owners often find that accounting demands more time and expertise than they can give. This is especially true for black-owned marketing agencies, which must balance growth, compliance, and financial clarity while competing in one of the world’s most demanding markets.

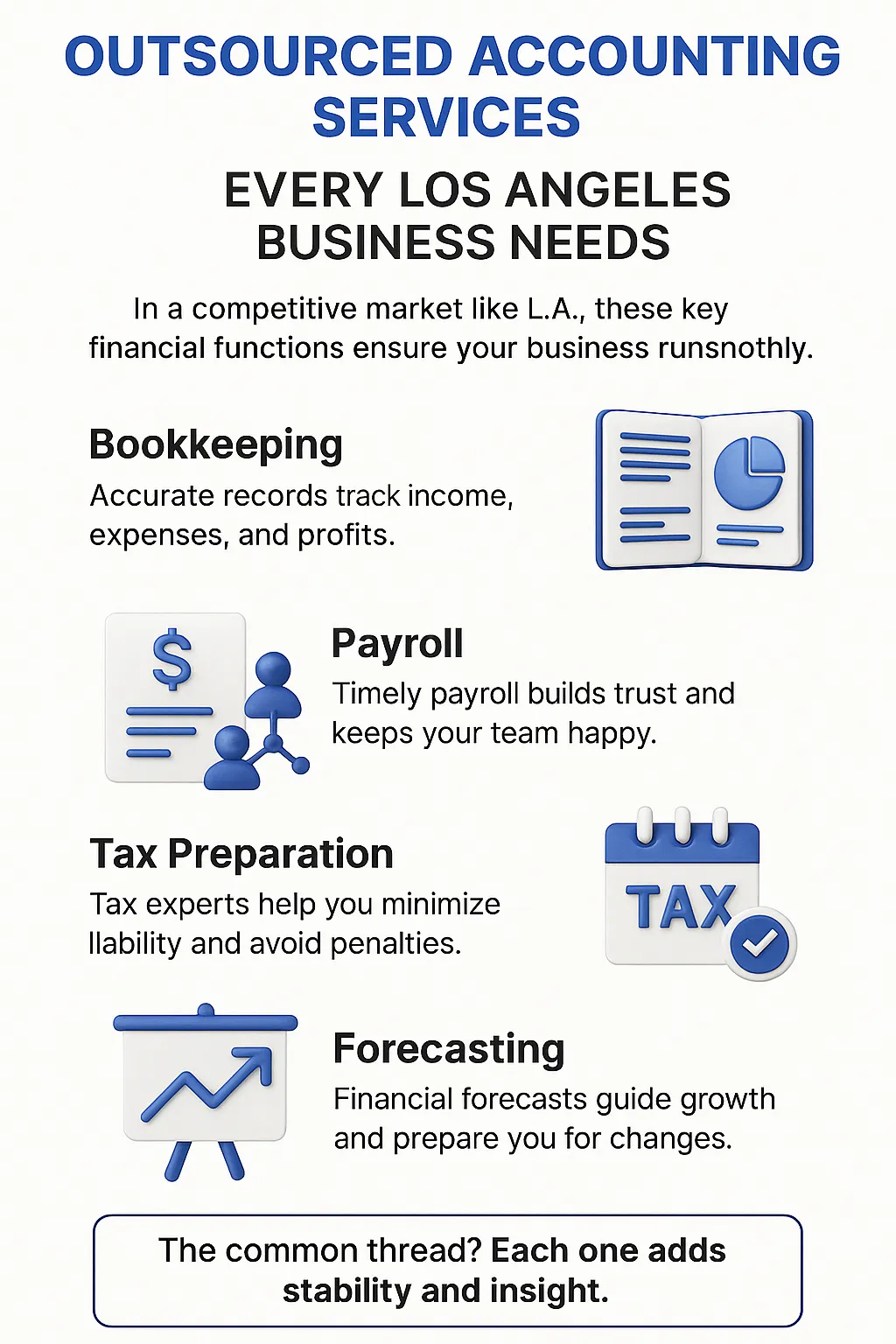

Outsourced accounting services provide a solution tailored to this fast-paced market. Professional firms offer essential services such as bookkeeping, tax preparation, payroll management, and financial forecasting. More importantly, they bring local expertise—understanding how state laws, city regulations, and industry-specific rules impact Los Angeles companies.

For startups, outsourcing means affordable access to high-level financial support without the cost of a full-time hire. For established businesses, it ensures accurate reporting, compliance, and strategic insights that drive growth. The result is more than just clean books—it’s the confidence to scale in one of the most competitive markets in the world.

“Los Angeles businesses face a financial landscape unlike any other—where city regulations, state tax codes, and industry pressures collide. In my experience, those who outsource their accounting gain more than compliance; they gain clarity. The right partner uncovers inefficiencies, strengthens cash flow, and gives business owners the freedom to focus on growth in one of the most competitive markets in the world.”

Case Study & Real-World Examples

Creative Agency in Los Angeles

Thrived creatively but lacked financial clarity.

Founders spent hours on spreadsheets.

California tax codes added stress.

After outsourcing:

Tailored monthly reports by project.

Underpriced service line corrected.

Payroll streamlined.

Result: 18% profit margin increase + 15 hours per week saved.

Restaurant Group in L.A.

Steady business but cash-strapped.

Struggled with thin margins and rising costs.

After outsourcing:

Supplier contracts reviewed and renegotiated.

Thousands saved annually.

Cash flow forecasting added confidence.

Result: Clear financial planning + expansion into new neighborhoods.

Research Insight

99.9% of California businesses are small businesses.

Nearly half the state’s workforce is employed by them (SBA.gov).

Many operate with limited resources. Outsourcing levels the playing field.

Lessons Learned

Financial blind spots—not lack of demand—often hold growth back.

Outsourcing uncovers hidden costs and opportunities.

Time saved on bookkeeping fuels growth-driving work.

In L.A., financial clarity is as valuable as creativity.

For multicultural marketing agencies, these case studies show that outsourced accounting not only uncovers hidden costs but also creates the financial clarity needed to scale sustainably in competitive markets like Los Angeles.

Thrived creatively but lacked financial clarity.

Founders spent hours on spreadsheets.

California tax codes added stress.

After outsourcing:

Tailored monthly reports by project.

Underpriced service line corrected.

Payroll streamlined.

Result: 18% profit margin increase + 15 hours per week saved.

Steady business but cash-strapped.

Struggled with thin margins and rising costs.

After outsourcing:

Supplier contracts reviewed and renegotiated.

Thousands saved annually.

Cash flow forecasting added confidence.

Result: Clear financial planning + expansion into new neighborhoods.

99.9% of California businesses are small businesses.

Nearly half the state’s workforce is employed by them (SBA.gov).

Many operate with limited resources. Outsourcing levels the playing field.

Financial blind spots—not lack of demand—often hold growth back.

Outsourcing uncovers hidden costs and opportunities.

Time saved on bookkeeping fuels growth-driving work.

In L.A., financial clarity is as valuable as creativity.

Supporting Statistics & Insights

99.7% of net new jobs in California come from small businesses

Source: SBA.gov

Most L.A. companies are lean operations.

Outsourcing gives them big-firm infrastructure without big costs.

$10.9 billion in loans went to California small businesses in one year

Source: SBA.gov

Lenders demand clean financials.

Outsourced accounting improves credibility and loan approval odds.

Creative industries = 673,000 businesses and 3.48 million employees

Source: ArtsLearningDatabase.org

Los Angeles is the nation’s creative hub.

Outsourcing helps agencies manage royalties, budgets, and cash flow.

99.7% of net new jobs in California come from small businesses

Source: SBA.gov

Most L.A. companies are lean operations.

Outsourcing gives them big-firm infrastructure without big costs.

$10.9 billion in loans went to California small businesses in one year

Source: SBA.gov

Lenders demand clean financials.

Outsourced accounting improves credibility and loan approval odds.

Creative industries = 673,000 businesses and 3.48 million employees

Source: ArtsLearningDatabase.org

Los Angeles is the nation’s creative hub.

Outsourcing helps agencies manage royalties, budgets, and cash flow.

Final Thought & Opinion

Los Angeles is one of the most competitive business markets in the U.S. Small businesses drive job growth, billions in loans fuel expansion, and creative industries dominate the local economy. Opportunity is high—but so is pressure.

From experience, three truths stand out:

Financial clarity separates winners from strugglers. Owners who guess at profitability often miss growth or face compliance risks.

Outsourcing unlocks better decisions. Businesses that outsource accounting secure funding more easily and operate with confidence.

Time saved fuels growth. Leaders gain back hours to focus on clients, innovation, and expansion.

Opinion:

For Los Angeles businesses, outsourced accounting isn’t just helpful—it’s essential. It transforms accounting from an obligation into a growth strategy, giving companies the tools to scale faster and compete smarter.

Financial clarity separates winners from strugglers. Owners who guess at profitability often miss growth or face compliance risks.

Outsourcing unlocks better decisions. Businesses that outsource accounting secure funding more easily and operate with confidence.

Time saved fuels growth. Leaders gain back hours to focus on clients, innovation, and expansion.

Next Steps

Assess your situation

Track time spent on bookkeeping, payroll, and compliance. Note recurring problems like tax confusion or late reports.

Define priorities

Decide if you need bookkeeping, payroll, tax prep, or forecasting. Focus on what saves time or adds clarity.

Research providers

Choose firms experienced with Los Angeles businesses. Check reviews, case studies, and testimonials.

Ask key questions

How do they handle California tax rules?

Do they support your industry?

Can they scale with your growth?

Start small, then expand

Begin with essentials like bookkeeping or payroll. Add strategy and forecasting as needs grow.

For a purpose-driven marketing agency, taking these next steps ensures smarter financial decisions, stronger compliance, and the clarity needed to scale with confidence.

Assess your situation

Track time spent on bookkeeping, payroll, and compliance. Note recurring problems like tax confusion or late reports.

Define priorities

Decide if you need bookkeeping, payroll, tax prep, or forecasting. Focus on what saves time or adds clarity.

Research providers

Choose firms experienced with Los Angeles businesses. Check reviews, case studies, and testimonials.

Ask key questions

How do they handle California tax rules?

Do they support your industry?

Can they scale with your growth?

Start small, then expand

Begin with essentials like bookkeeping or payroll. Add strategy and forecasting as needs grow.